Finalist in the 2013 Design For Experience Awards / Featured on UXMag.com

Course: Senior Studio

School: Carnegie Mellon University

Role: Concept, Project Scope, Research, Diagramming, Ideation, Sketching, Prototyping, Interaction Design, Visual Design

Year: 2013

How do you help college students understand and take control of their financial well-being?

Today we are facing a new age of invisible money that is preventing individuals from understanding the basic skill of budgeting, and is therefore leading to a decreased quality of life. While individuals' financial literacy is declining, debt from credit cards, car payments, mortgages, and student loans are rising at an alarming rate. This debt is occurring because individuals are spending more money than they can afford, which is very easy to do as credit and debit have become increasingly popular yet dangerous methods of payment that allow for rapid overspending. A growing percentage of the population currently spends so much time worrying about their financial situations that they are distracted from enjoying their everyday lives. We cannot reverse the personal financial damage that has already been done, but we can prevent more individuals from making the same mistakes by giving them the means to create and maintain a personal budget, which will ultimately result in improved well being.

College Students and Money

At the very beginning of this project, I collected an initial survey to see what college students think about financial literacy in order to gain insight into their current perceptions of the topic. The aim of this initial research was to decide on an appropriate topic area within financial literacy that warrants a design solution and would be helpful for the target audience. I also conducted first person interviews to find out about college students’ lifestyles and living practices to see if there was an opportunity for design intervention. The responses collected during these interviews also helped determine a project direction and focus as well as to steer the project toward physical or digital manifestation. After completing preliminary concept ideation based on survey results and interviews, I completed an informal round of speed dating for concept verification in moving forward.

Important Insights

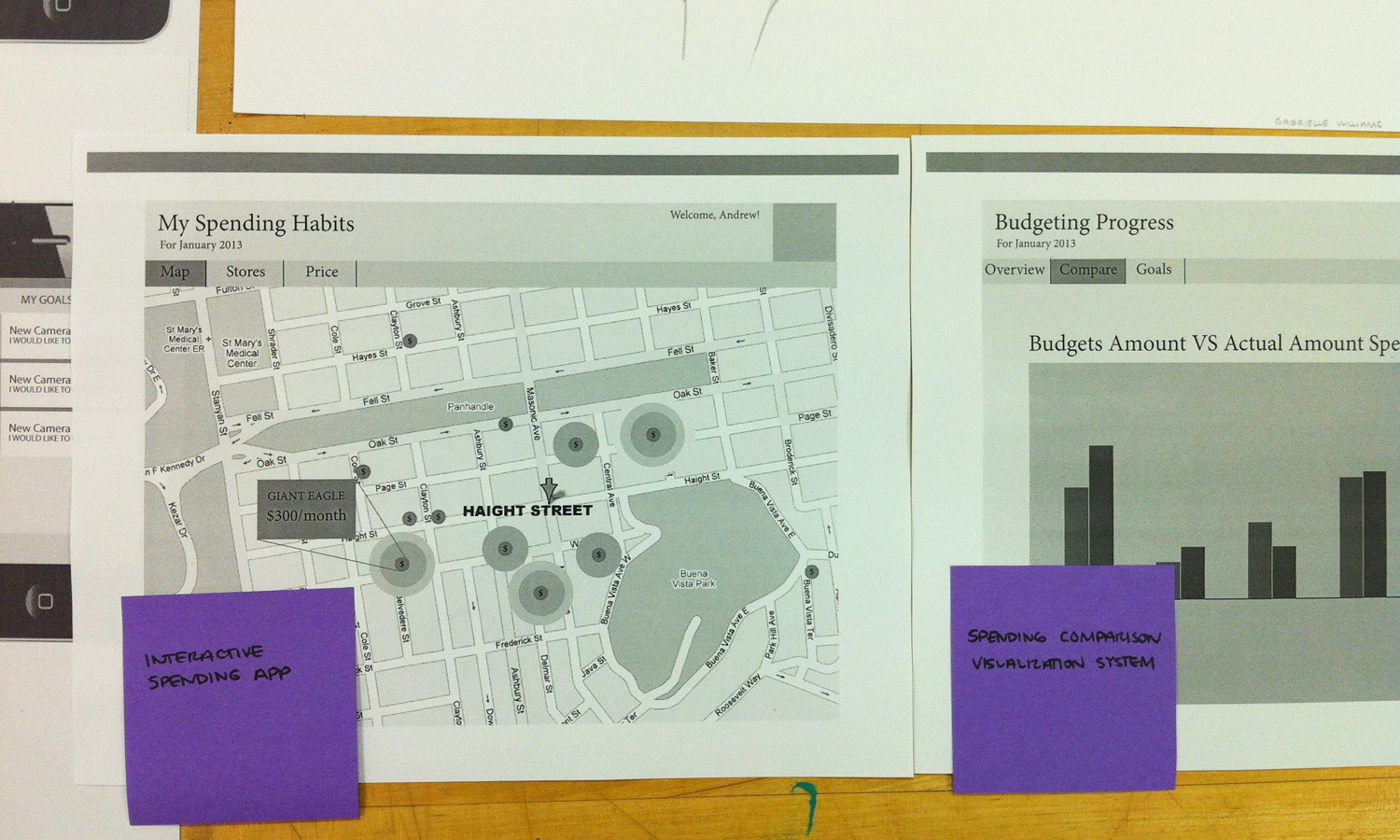

There were several important insights collected from these interviews. The first is that the designed solution needs to be very visual in order to be effective. Another was that students most everyone pays with a debit or credit card these days and if they don’t already, they are planning to make the swtich soon. Most participants made it clear that they do not keep track of the money they are saving or spending on a daily basis because they have busy schedules that do not allow them time to track finances. School-related activities cause students to spend money in various contexts that are unpredictable yet unavoidable. It also became clear that participants would not be inclined to carry around a physical object to help them with their finances, and so the solution needs to be virtual.

The Real Problem

The problem that really needs to be solved is giving people agency over their personal finances, giving them a tool that supports them in working with their financial situations closely enough and comfortably enough that they will be empowered to take control over their personal finances for the rest of their lives.

Meaningful Participation

The idea is that the user starts out with the system in college, when theyhave a general understanding of money. They then begin learning how to observe and practice money within their personal lifestyle, so that by the time they graduate and have larger financial decisions, they are prepared to handle them instead of being scared to confront them.

Building Awareness and Understanding

This system is not purely a visualization of one’s money or an online bank account. The focus is not to just track money goals, visualize money in the bank, or to keep track of purchases, although all of these actions take part in the overall concept. The goal is to give the user full awareness and understanding of how their financial actions affect their financial health and realize that they can successfully manage their money by paying attention to this relationship.

Attributes for Success

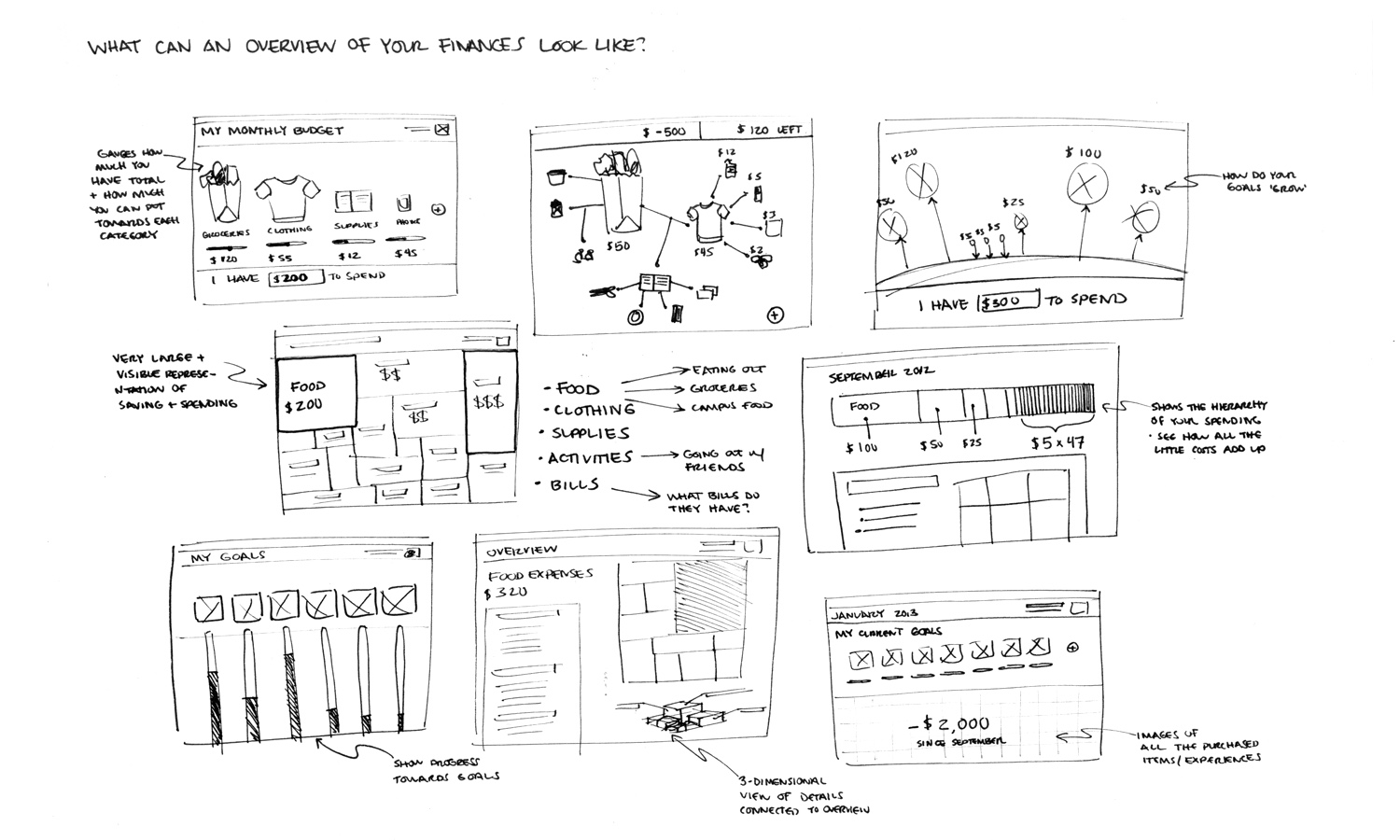

Some themes emerged through this concepting phase:

Personalized: It needs to be personalized and customizable

Adaptive: It needs to be flexible to the user's lifestyle

Organized: It needs to allow for financial organization and management

Reflective: It needs to encourage reflection with cause and effect

Concept Validation

After sketching out the three main directions to explore, I used the method of speed-dating to show the concepts to potential users and receive validation. In order to quickly demonstrate the concepts, I created short storyboards of scenarios for the users to view which were accompanied by a guiding question. The guiding questions primed the users to be imaginitive and receptive to the unfamiliar concepts, and then scenarios allowed the users to envision themselves in the story, using the financial tool describe in each. The results from this method were incredibly positive and each concept received interest and support from potential users.

Budgie Is Your Buddy

The designed solution is a learning tool for personal finance that exists as a system on digital platforms. It is comprised of three main informational and interactive hubs that work together to communicate a comprehensive state of the user’s finances. The hubs are personal, social, and experience-based and allow the user varied functions within each. For example, in the personal hub the user is able to dive deep into their financial habits and gain an understanding of how they are progressing towards financial goals. Whereas in the social hub, the user is able to communicate within a chosen community of people to find support and gain accountability for their financial actions. The experiential hub focuses on reflection to bring awareness to financial actions.

How Budgie Works

Customizable Dashboard: Allows the user to adjust their main view to match their financial priorities.

Savings Challenges: Allows the user to create and keep on track with money-saving challenges that fit into their lifestyle.

Financial Hubs: Organizes the user’s finances into three discrete groupings and intuitive viewing order.

Future Projections Tool: Allows the user to view a projection of their finances in the context of their financial experiences.